Futures Resources

Your source for futures trading insights to enhance your trading skills and strategies.

Futures Calculator

Use this tool to figure out what you could potentially make or lose on a trade.

Learn More

Futures Quotes & Charts

Our futures quotes and commodity charts include complete market data and enhanced features such as key technical numbers.

Learn More

Navigating the 2024 Election: Market Insights and Strategies with Kathryn Rooney Vera

Gain valuable insights and strategies for navigating the 2024 election with an exclusive interview featuring Chief Market Strategist Kathryn Rooney Vera, and Head of Market Research Matt Weller.

Learn More

CME Group Resource Center

Whether you’re looking for new trading opportunities or a capital efficient way to manage portfolio risk, futures and options on futures offer a wide array of products to accomplish either objective. Start today by watching CME Group's top 5 reasons why traders come to the futures markets.

Learn More

Commitments of Traders Report Explanation

The Commitment-of-Traders (COT) reports can sometimes give traders a good idea of future significant moves in the market. The CFTC requires large speculators and commercial traders, or hedgers, to report their net positions twice each month.

Learn More

Webinar: Intro to Futures and Forex Trading

Discover the power of CME Group futures & Forex.com forex trading with experts from Forex.com and StoneX Financial Inc. Gain insights on trading fundamentals and tools. Watch the on-demand webinar now!

Learn More

Webinar: Navigating Market Shifts: Economic Events & CME Group Equity Index Options

Explore how to navigate market shifts with CME Group Equity Index Options in our webinar. Learn about how key economic events like reports and elections can impact the markets. Sign up now!

Learn More

Contracts Traded

Founded in 1898 as a not-for-profit corporation, in November 2000 CME became the first U.S. financial exchange to demutualize and become a shareholder-owned corporation. View information here to expand your knowledge.

Learn More

Expiration Months

View a brief introduction to CME’s hand signals. Anyone who works on the Exchange floors needs to know and use these signals perfectly. Hand signals are essential for successful pit trading at CME, and using the wrong signal could result in a substantial loss.

Learn More

Fundamental Analysis

Fundamental analysis is the study of the factors that affect supply and demand. The key to fundamental analysis is to gather and interpret this information and then to act before this information is incorporated into the futures price. This lag time between an event and its resulting market response presents a trading opportunity for the fundamentalist.

Learn More

Futures Contract

A futures contract is an agreement to buy or sell a commodity at a date in the future. Everything about a futures contract is standardized except its price. All of the terms under which the commodity, service or financial instrument is to be transferred are established before active trading begins, so neither side is hampered by ambiguity.

Learn More

Futures Exchange

Futures contracts are traded at a futures exchange and only at a futures exchange. Chicago Mercantile Exchange (CME), like the other exchanges in the U.S., provides a place to trade, formulates rules for trading and supervises trading practices. There are currently eight futures exchanges in the U.S.

Learn More

GLOBEX

GLOBEX is Chicago Mercantile Exchange’s global electronic trading system. The system offers computerized order entry and trade matching on a wide range of futures and options products, virtually 24 hours a day, to people around the world.

Learn More

Hand Signals

Hand signals – the sign language of futures trading — represent a unique system of communication that effectively conveys the basic information needed to conduct business on the trading floor.

Learn More

Hedgers & Speculators

Speculators are people who analyze and forecast futures price movement, trading contracts with the hope of making a profit. The producers and users of commodities who use the futures market are called hedgers.

Learn More

Options on Futures

Options on futures were introduced in the 1980s. An option contract allows you the right, but not the obligation, to buy or sell an underlying futures contract at a particular price. View information here to expand your knowledge.

Learn More

Orders in the Pit

A futures brokerage firm (“house”) that is a member of Chicago Mercantile Exchange (CME) places orders to buy or sell futures or options contracts for companies or individuals and earns a commission on each transaction. Everyone who trades futures and options on futures contracts must have an account with a futures brokerage house, which is officially called Futures Commission Merchant (FCM).

Learn More

Reading Quotes

Futures prices are published for every trading session, and previous day prices are reported daily in major newspapers such as The Wall Street Journal (Section 2). You can also get prices for contracts traded at CME on the CME web site www.cmegroup.com and from a number of different quote vendors.

Learn More

Supply and Demand

The price of a product or a commodity depends on the relationship between supply and demand. If the supply and demand curves are placed on the same graph, the point where they intersect is the product’s market price. Based on all the supply and demand factors, this is the price discovered as people buy and sell the commodity or trade futures.

Learn More

Technical Analysis

This approach to price prediction is based on the premise that price movements follow consistent historical patterns. Those who engage in technical analysis study charts or statistics that measure price movements and try to find repetitive patterns.

Learn More

Trading Pit

Even though more and more futures contracts are being traded online, there’s still plenty of action in the trading pits at Chicago Mercantile Exchange (CME) and other U.S. exchanges. That’s where traders determine futures prices, which change from minute to minute as trading goes on.

Learn More

Risk Management

Risk management and financial surveillance are the two primary functions of CME’s financial safeguard system. The system is designed to provide the highest level of safety and the early detection of unsound financial practice on the part of any clearing member.

Learn More.png)

Futures and Options Strategy Guide

The strategies in this futures options strategy guide are not intended to provide a complete guide to every possible trading strategy.

Learn More.png)

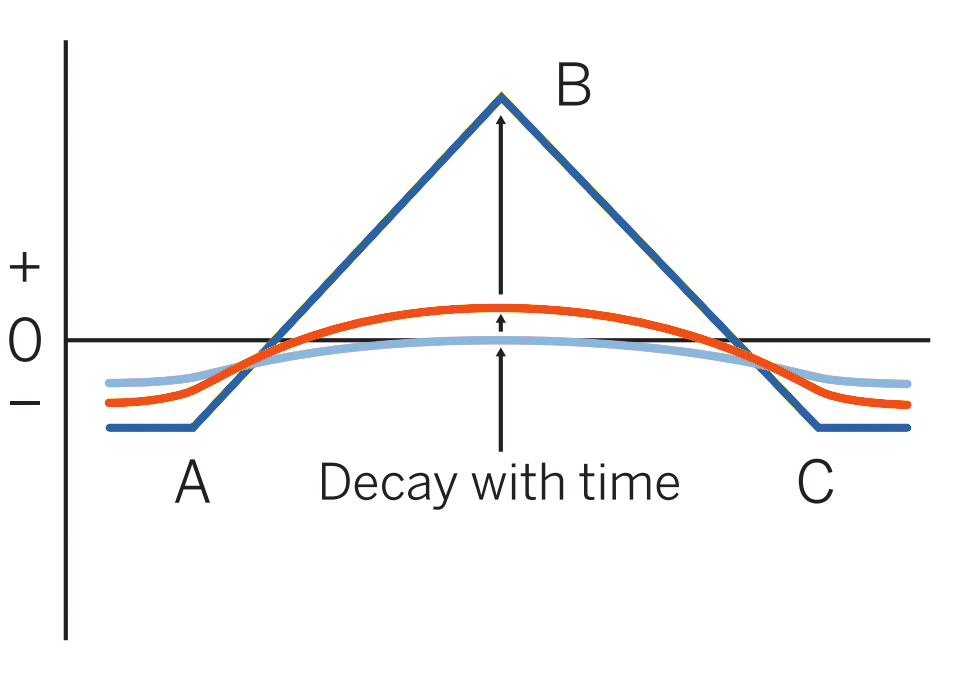

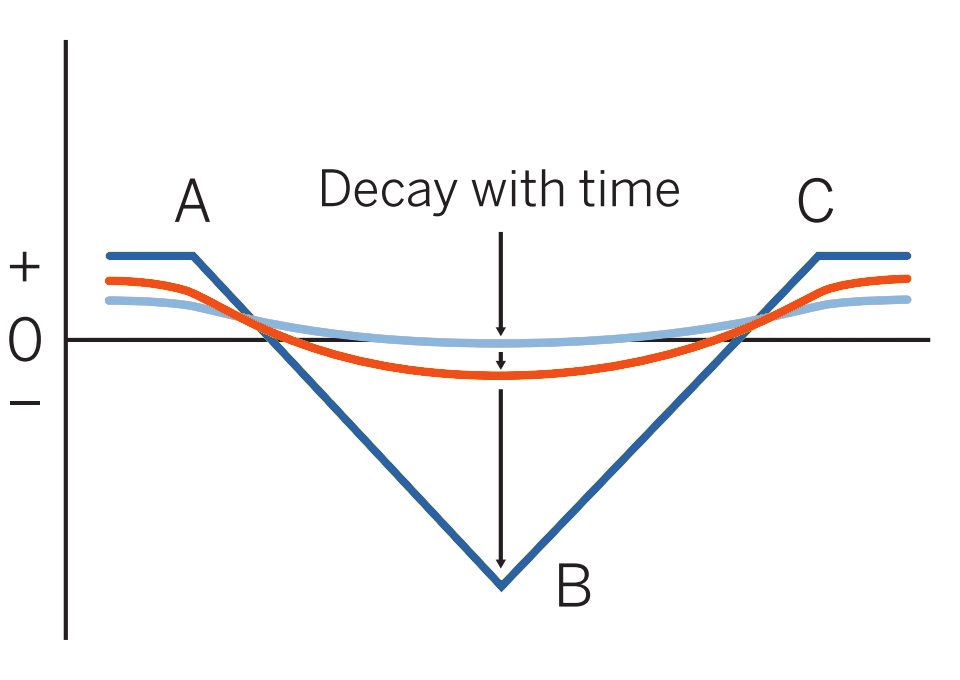

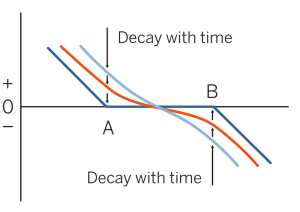

Futures & Options Strategies: Bear Spread

Use this if you think the market will go down, but with limited downside. Good position if you want to be in the market but are less confident of bearish expectations.

Learn More

Futures & Options Strategies: Box or Conversion

Occasionally, a market will get out of line enough to justify an initial entry into one of these positions. However, they are most commonly used to “lock” all or part of a portfolio by buying or selling to create the missing “legs” of the position.

Learn More

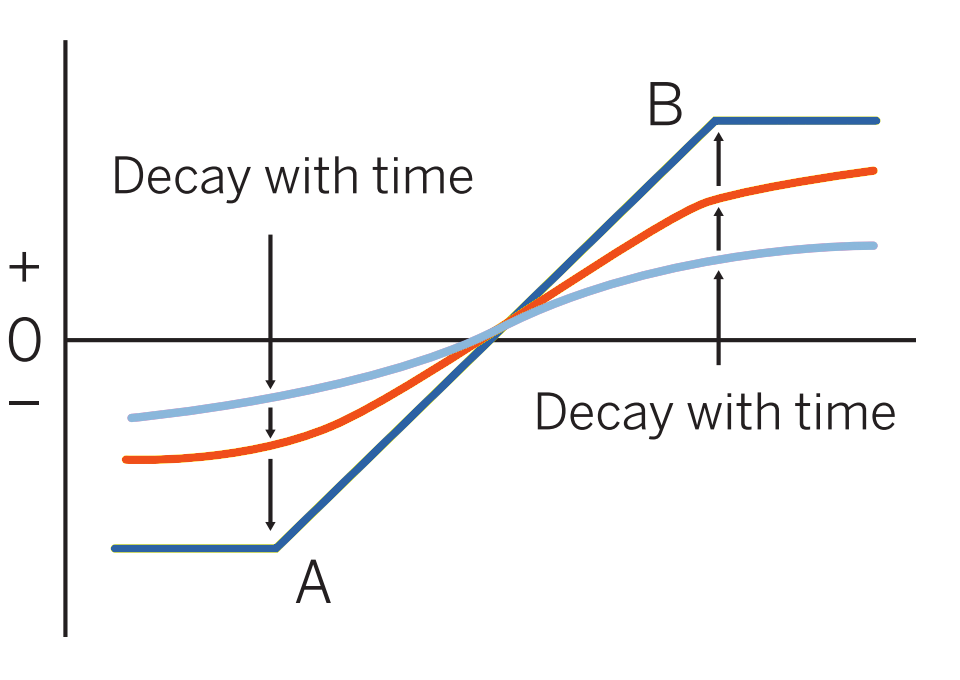

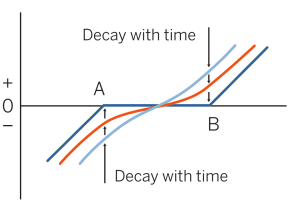

Futures & Options Strategies: Bull Spread

Use this strategy if you think the market will go up, but with limited upside. Good position if you want to be in the market but are less confident of bullish expectations.

Learn More

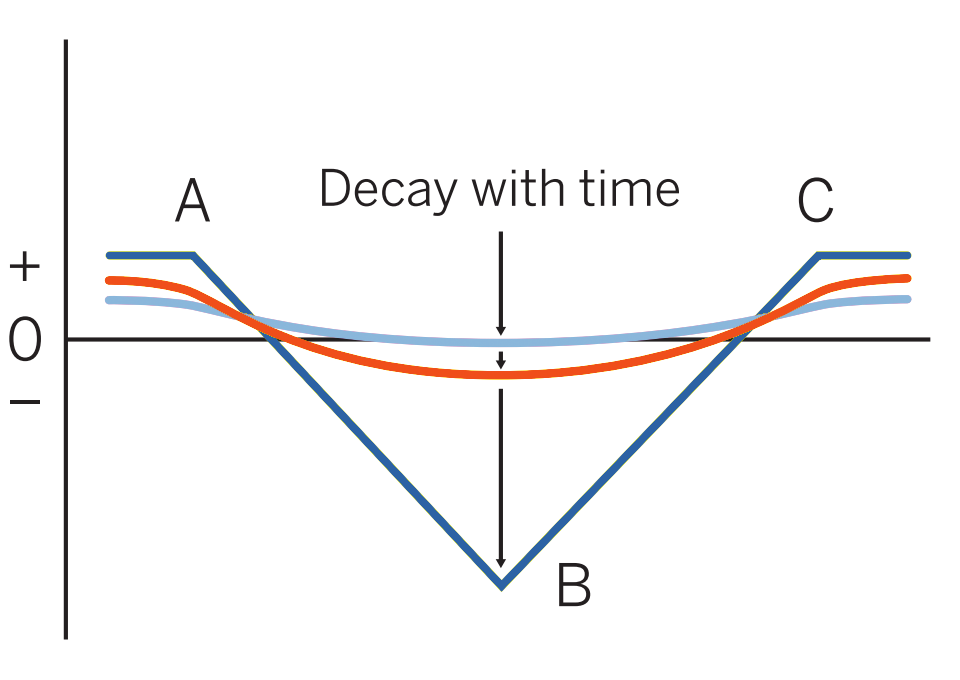

Futures & Options Strategies: Long Butterfly

One of the few positions which may be entered advantageously in a long-term options series. Enter when, with one month or more to go, cost of the spread is 10 percent or less of B – A (20 percent if a strike exists between A and B).

Learn More

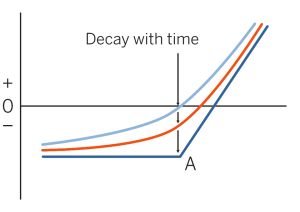

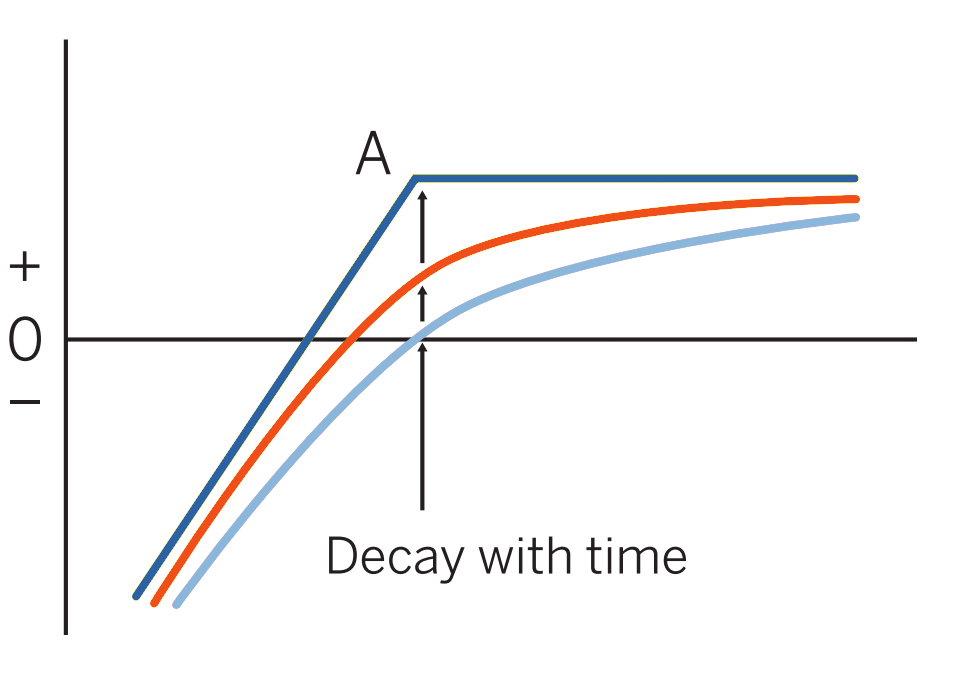

Futures & Options Strategies: Long Call

Use this strategy when you are bullish to very bullish on the market. In general, the more out-of-the-money (higher strike) calls, the more bullish the strategy.

Learn More

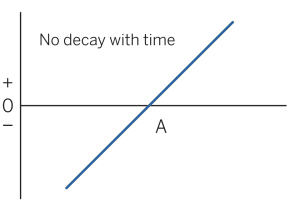

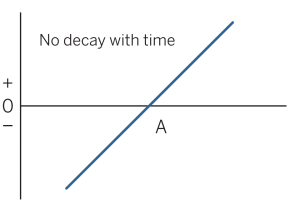

Futures & Options Strategies: Long Futures Trading Strategy Guide

Long futures positions may make sense when you are bullish on the market and uncertain about volatility. You will not be affected by volatility changing.

Learn More

Futures & Options Strategies: Long Iron Butterfly

This strategy is best for traders who anticipate very little price movement in the underlying asset and want to profit from low volatility conditions by collecting premium income from selling options, while also limiting potential losses through the purchase of options at wider strike prices.

Learn More

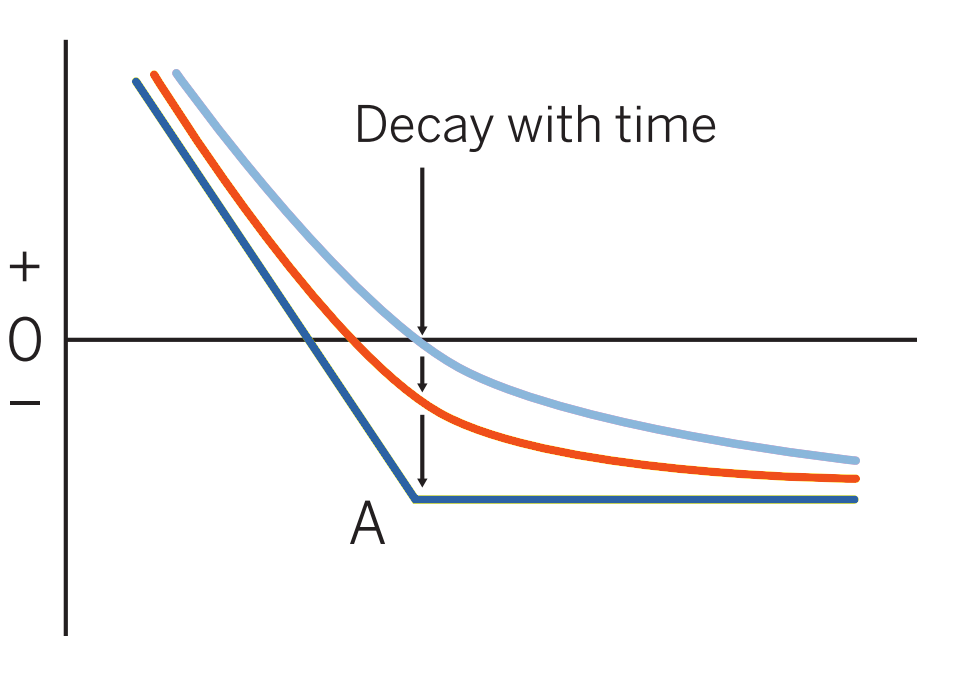

Futures & Options Strategies: Long Put Options Trading Strategy

Long put options may be a strategy to consider when you are bearish to very bearish on the market. Profit increases as markets fall.

Learn More

Futures & Options Strategies: Long Risk Reversal

When you are bullish on the market and uncertain about volatility. Normally this position is initiated as a follow-up to another strategy. Its risk/reward is the same as a LONG FUTURES except that there is a flat area of little or no gain/loss.

Learn More

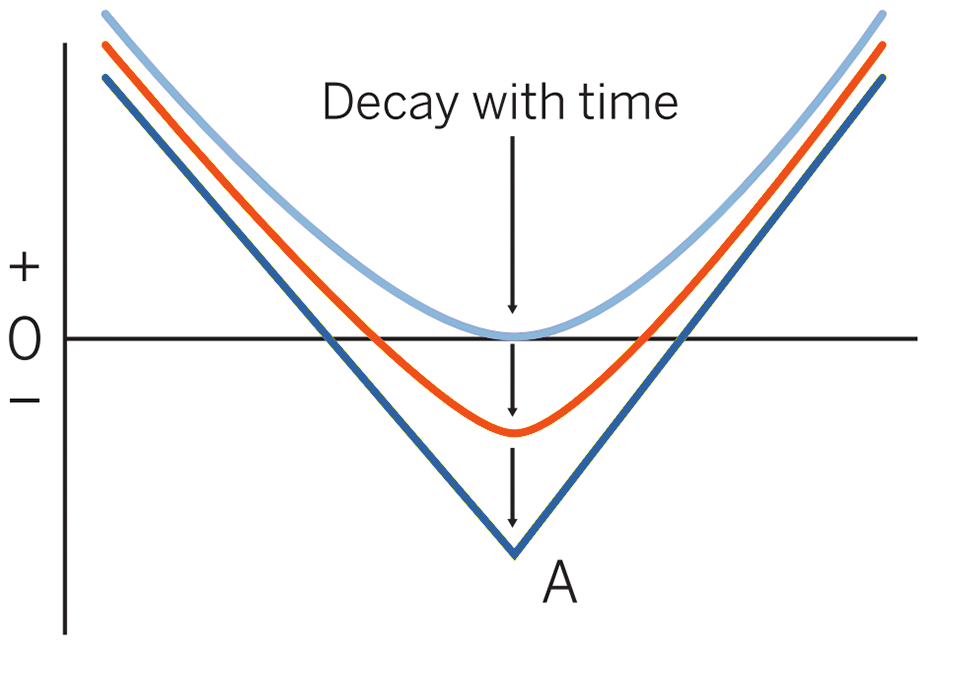

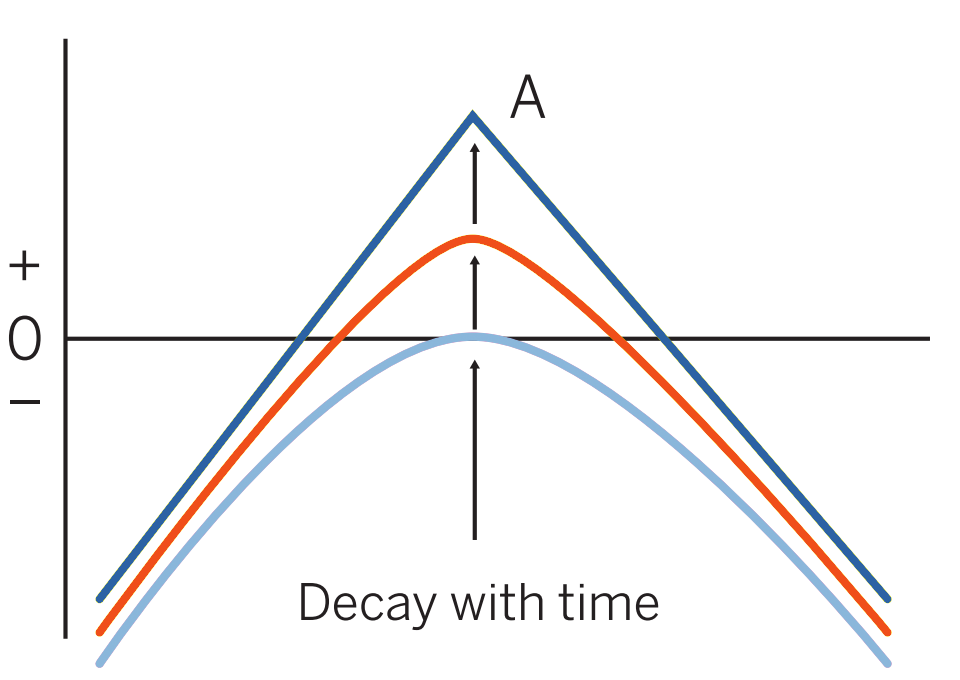

Futures & Options Strategies: Long Straddle Pattern

This trader looks at the low implied volatility and feels that options are relatively inexpensive. The expectation is the market is poised for a big move

Learn More.png)

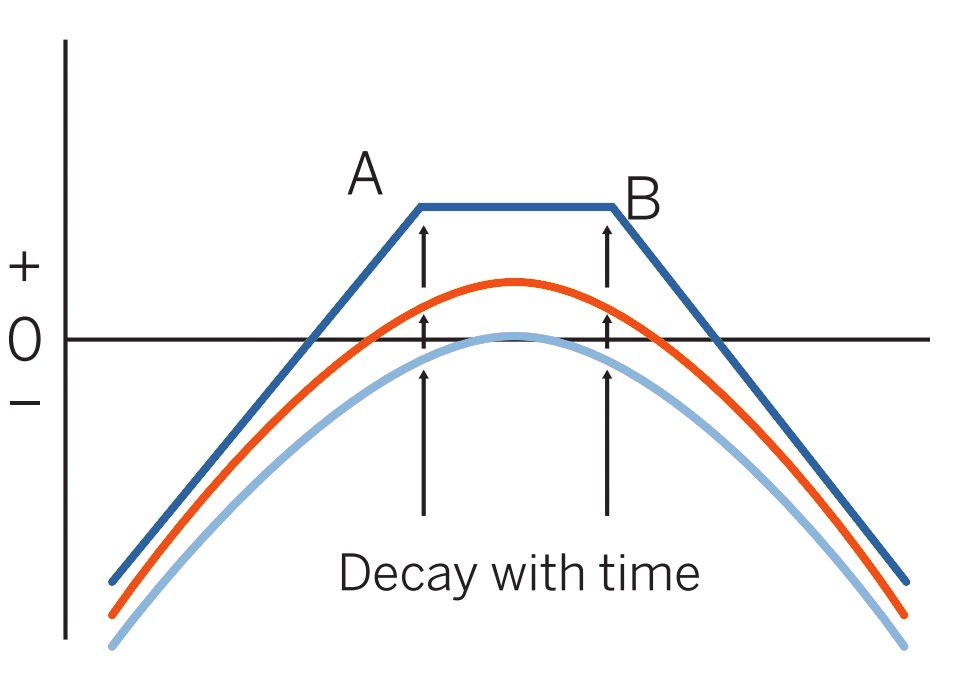

Futures & Options Strategies: Long Strangle

If market is within or near (A-B) range and has been stagnant. If market explodes either way, you make money; if market continues to stagnate, you lose less than with a long straddle. Also useful if implied volatility is expected to increase.

Learn More

Futures & Options Strategies: Long Synthetic Futures

When you are bullish on the market and uncertain about volatility. You will not be affected by volatility changing. However, if you have an opinion on volatility and that opinion turns out to be correct, one of the other strategies may have greater profit potential and/or less risk. May be traded into from initial long call or short put position to create a stronger bullish position.

Learn More

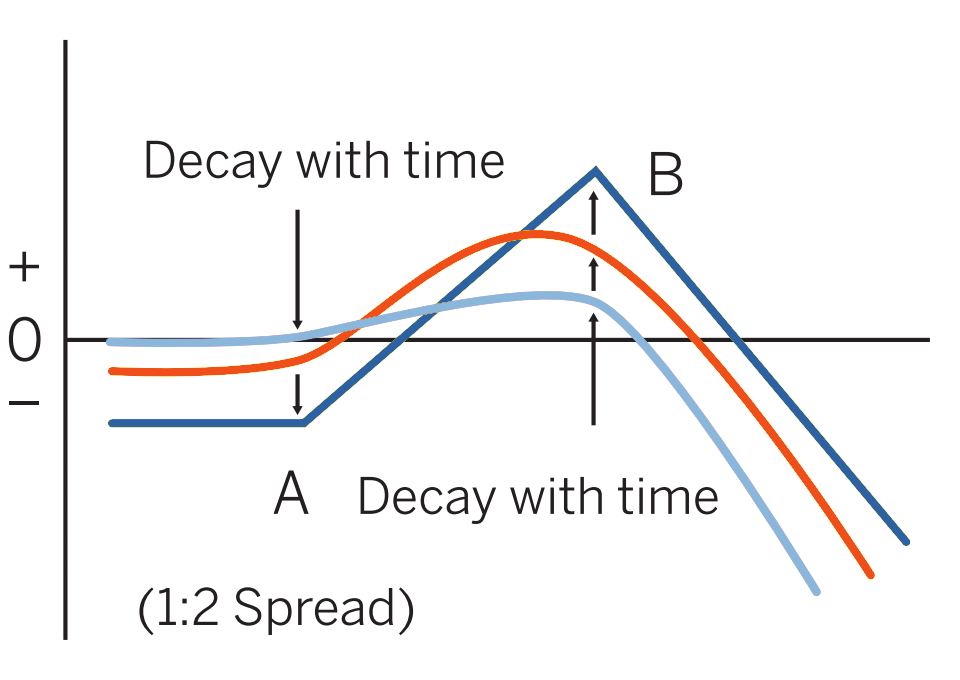

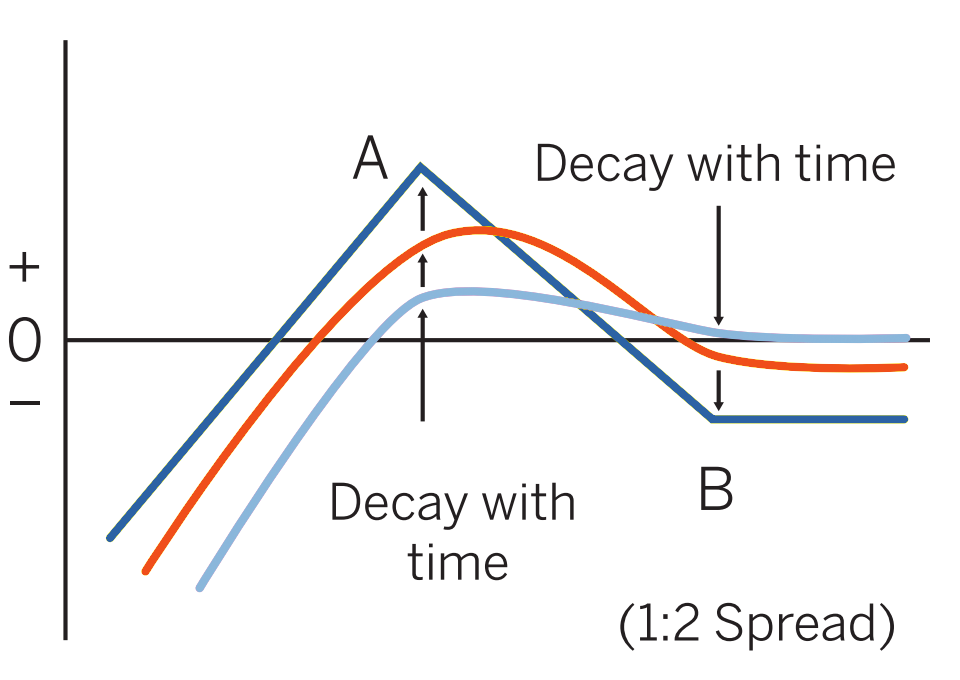

Futures & Options Strategies: Ratio Call Backspread

Normally entered when market is near B and shows signs of increasing activity, with greater probability to upside.

Learn More

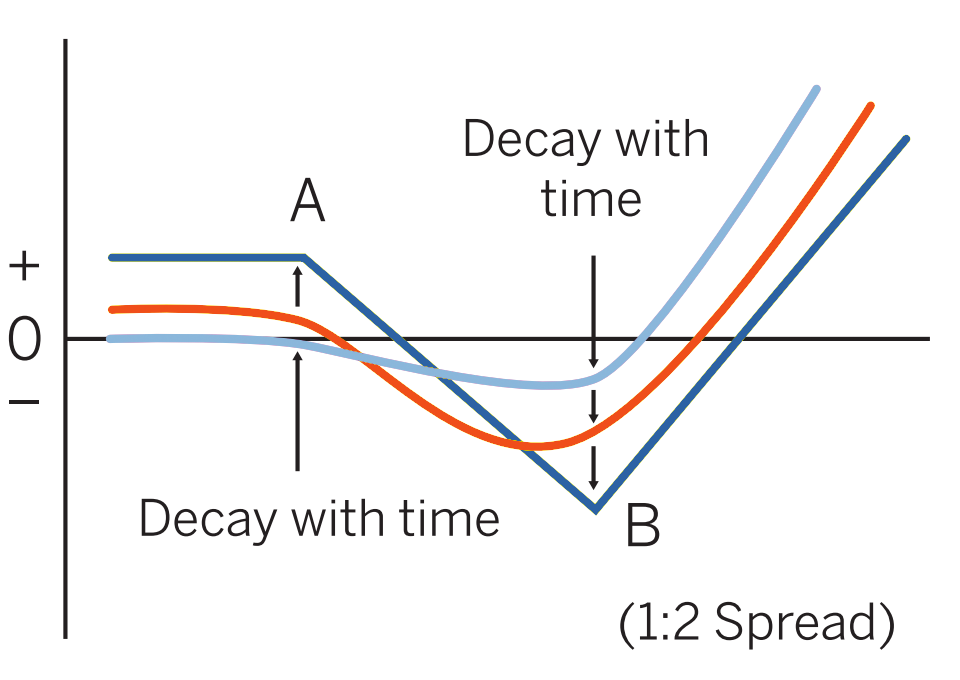

Futures & Options Strategies: Ratio Call Spread

Usually entered when market is near A and user expects a slight to moderate rise in market but sees a potential for sell-off. One of the most common option spreads, seldom done more than 1:3 (two excess shorts) because of upside risk.

Learn More

Futures & Options Strategies: Ratio Put Backspread

Normally entered when market is near A and shows signs of increasing activity, with greater probability to downside (for example, if last major move was up, followed by stagnation).

Learn More

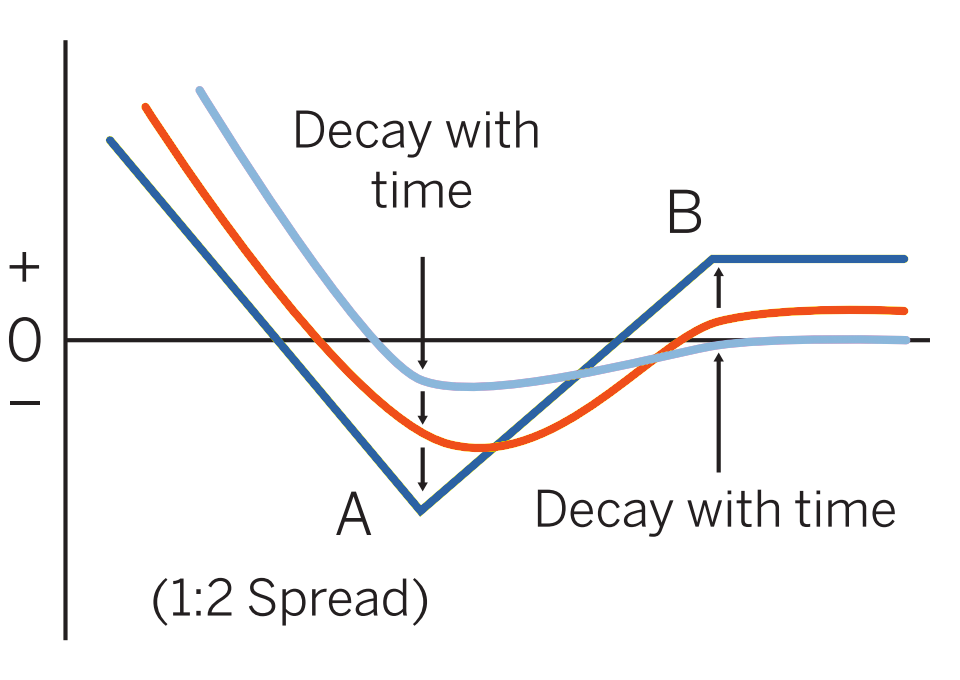

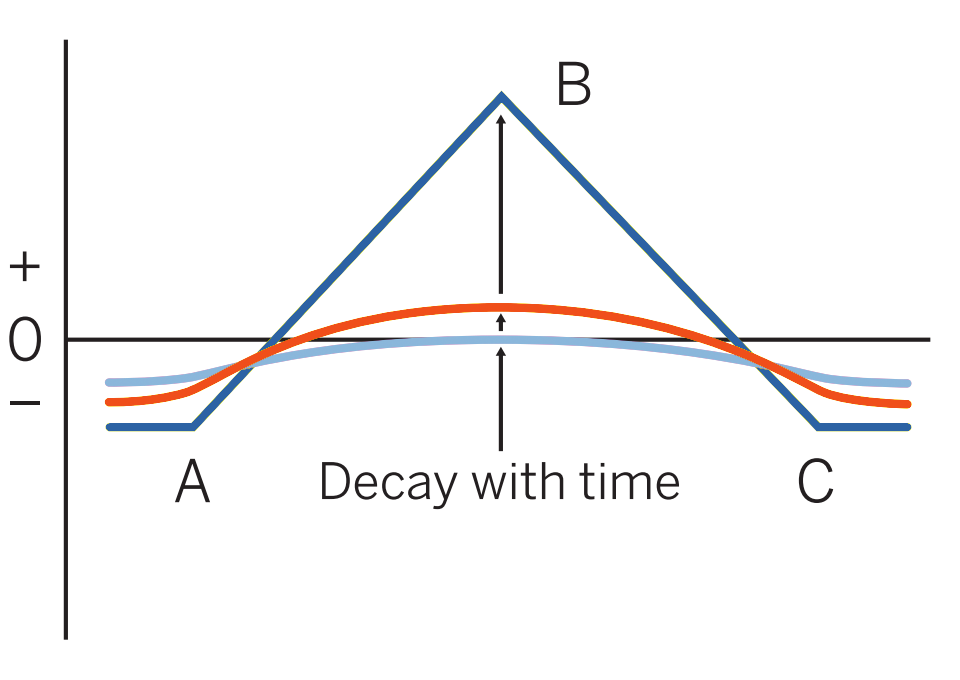

Futures & Options Strategies: Ratio Put Spread

Usually entered when market is near B and you expect market to fall slightly to moderately, but see a potential for sharp rise. One of the most common option spreads, seldom done more than 1:3 (two excess shorts) because of downside risk.

Learn More

Futures & Options Strategies: Short Butterfly

When the market is either below A or above C and position is overpriced with a month or so left. Or when only a few weeks are left, market is near B, and you expect an imminent move in either direction.

Learn More

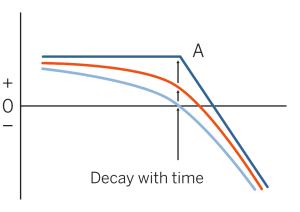

Futures & Options Strategies: Short Call

When you are bearish on the market. Sell out- of-the-money (higher strike) puts if you are less confident the market will fall, sell at-the-money puts if you are confident the market will stagnate or fall.

Learn More

Futures & Options Strategies: Short Iron Butterfly

Enter when the Short Iron Butterfly’s net credit is 80 percent or more of C – A, and you anticipate a prolonged period of relative price stability where the underlying will be near the mid-point of the C – A range close to expiration. This is a rule of thumb; check theoretical values.

Learn More

Futures & Options Strategies: Short Put

If you firmly believe the market is not going down. Sell out-of-the-money (lower strike) options if you are only somewhat convinced, sell at-the-money options if you are very confident the market will stagnate or rise. If you doubt market will stagnate and are more bullish, sell in-the-money options for maximum profit.

Learn More

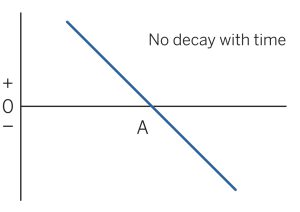

Futures & Options Strategies: Short Risk Reversal

When you are bearish on the market and uncertain about volatility. Normally this position is initiated as a follow-up to another strategy. Its risk/reward is the same as a SHORT FUTURES except that there is a flat area of little or no gain/loss.

Learn More

Futures & Options Strategies: Short Straddle

If market is near A and you expect market is stagnating. Because you are short options, you reap profits as they decay — as long as market remains near A.

Learn More

Futures & Options Strategies: Short Strangle

If market is within or near (A-B) range and, though active, is quieting down. If market goes into stagnation, you make money; if it continues to be active, you have a bit less risk then with a short straddle.

Learn More

Futures & Options Strategies: Short Synthetic Futures

Short synthetic futures positions may make sense when you are bearish on the market and uncertain about volatility.

Learn More

Futures Trading Glossary

This glossary was compiled by the CME from a number of sources. The definitions are not intended to state or suggest the correct legal significance of any word or phrase. The sole purpose of this compilation is to foster a better understanding of the futures market.

Learn More

Key Market Report Definitions

Definitions of key market reports and their explanations are available to build your knowledge on the markets and trading. Definitions of key areas and reports can be found on our page including; financial/economic, metal market, energy market, grain/oilseed, livestock, softs and weather models.

Learn More

Forward Contract Introduction - Khan Academy Tutorials

This video provides an introduction to forward contracts.

Learn More

Futures Introduction - Khan Academy Tutorials

This video provides an introduction to futures.

Learn More

Motivation for the Futures Exchange - Khan Academy Tutorials

This video discusses motivation for the futures exchange.

Learn More

Backwardation Bullish or Bearish - Khan Academy Tutorials

This video discusses backwardation bullish.

Learn More

Contango from Trader Perspective - Khan Academy Tutorials

This video discusses contango from the trader's perspective.

Learn More

Backwardation - Khan Academy Tutorials

This video discusses backwardation.

Learn More

Contango and Backwardation Review - Khan Academy Tutorials

This video discusses contango and backwardation.

Learn More

Futures and Forward Curves - Khan Academy Tutorials

This video discusses futures and forward curves.

Learn More

Futures Curves II - Khan Academy Tutorials

This video discusses futures curves.

Learn More

Futures Fair Value in the Pre-Market - Khan Academy Tutorials

This video discusses futures fair value in the pre-market.

Learn More

Interpreting Futures Fair Value in the Pre-Market - Khan Academy Tutorials

This video discusses interpreting futures fair value in the premarket.

Learn More

Futures Margin Mechanics - Khan Academy Tutorials

This video discusses futures margin mechanics.

Learn More

Severe Contango Generally Bearish - Khan Academy Tutorials

This video discusses severe contango generally bearish.

Learn More

Upper Bound on Forward Settlement Price - Khan Academy Tutorials

This video discusses upper bound on forward settlement price.

Learn More

Lower Bound on Forward Settlement Price - Khan Academy Tutorials

This video discusses lower bound on forward settlement price.

Learn More

Verifying Hedge with Futures Margin Mechanics - Khan Academy Tutorials

This video discusses verifying hedge with futures margin mechanics

Learn More

Arbitraging Futures Contract - Khan Academy Tutorials

This video discusses arbitraging futures contracts.

Learn More

Arbitraging Futures Contracts II - Khan Academy Tutorials

This video is part two of a series on arbitraging futures contracts.

Learn More

American Call Options - Khan Academy Tutorials

This video discusses American call options.

Learn More

Basic Shorting - Khan Academy Tutorials

This video discusses basic shorting.

Learn More

American Put Options - Khan Academy Tutorials

This video discusses Aerican put options.

Learn More

Call Option as Leverage - Khan Academy Tutorials

This video discusses call option as leverage.

Learn More

Put vs. Short and Leverage - Khan Academy Tutorials

This video discusses put vs. short and leverage.

Learn More

Call Payoff Diagram - Khan Academy Tutorials

This video discusses call payoff diagrams.

Learn More

Put Payoff Diagram - Khan Academy Tutorials

This video discusses put put payoff diagrams.

Learn More

Put as Insurance - Khan Academy Tutorials

This video discusses put as insurance.

Learn More

Put-Call Parity - Khan Academy Tutorials

This video discusses put call parity.

Learn More

Long Straddle Pattern Tutorial - Khan Academy Tutorials

This video describes how to use and profit from the long straddle pattern.

Learn More

Put Writer Payoff Diagrams - Khan Academy Tutorials

This video discusses put writer payoff diagrams.

Learn More

Call Writer Payoff Diagram - Khan Academy Tutorials

This video discusses call writer payoff diagrams.

Learn More

Arbitrage Basics - Khan Academy Tutorials

This video discusses arbitrage basics.

Learn More

Put-Call Parity Arbitrage I - Khan Academy Tutorials

This video discusses put-call parity arbitrage.

Learn More

Put-Call Parity Arbitrage II - Khan Academy Tutorials

This is part two of a series of videos discussing put-call parity arbitrage.

Learn More

Put-Call Parity Clarification - Khan Academy Tutorials

This video discusses put-call parity clarification.

Learn More

Actual Option Quotes - Khan Academy Tutorials

This video discusses actual option quotes.

Learn More

Option Expiration and Price - Khan Academy Tutorials

This video discusses option expiration and price.

Learn More

Futures Markets

Access a variety of free information and resources to help you trade the futures markets. Browse through the list of contracts to find the latest information, including history, contract specifications, market news and more.

Learn More

Australian Dollar Futures

Learn contract specifications and facts about the Australian Dollar.

Learn More

Brazilian Real Futures

Learn contract specifications and facts about Brazilian Real futures.

Learn More

British Pound Futures

Learn contract specifications and facts about British Pound futures.

Learn More

Canadian Dollar Futures

Learn contract specifications and facts about Canadian Dollar. futures

Learn More

Euro FX Futures

Learn contract specifications and facts about Euro futures.

Learn More

Japanese Yen Futures

Learn contract specifications and facts about Japanese Yen futures.

Learn More

Mexican Peso Futures

Learn contract specifications and facts about Mexican Peso futures.

Learn More

New Zealand Dollar Futures

Learn contract specifications and facts about New Zealand Dollar futures.

Learn More

South African Rand Futures

Learn contract specifications and facts about South African Rand futures.

Learn More

Swiss Franc Futures

Learn contract specifications and facts about Swiss Franc futures.

Learn More

U.S. Dollar Index Futures

Learn contract specifications and facts about U.S. Dollar futures.

Learn More

Crude Oil Futures

Learn contract specifications and facts about crude oil futures.

Learn More

Ethanol Futures

Learn contract specifications and facts about ethanol futures.

Learn More

Heating Oil Futures

Learn contract specifications and facts about heating oil futures.

Learn More

Natural Gas Futures

Learn contract specifications and facts about natural gas futures.

Learn More

RBOB Gasoline Futures

Learn contract specifications and facts about RBOB gasoline futures.

Learn More

Canola Futures

Learn contract specifications and facts about canola futures.

Learn More

Corn Futures

Learn contract specifications and facts about corn futures.

Learn More

Rough Rice Futures

Learn contract specifications and facts about rough rice futures.

Learn More

Soybean Futures

Learn contract specifications and facts about soybean futures.

Learn More

Soybean Meal Futures

Learn contract specifications and facts about soybean meal futures.

Learn More

Soybean Oil Futures

Learn contract specifications and facts about soybean oil futures.

Learn More

Wheat Futures

Learn contract specifications and facts about wheat futures.

Learn More

30-Day Federal Funds

Learn contract specifications and facts about 30-day federal funds.

Learn More

Eurodollar Futures

Learn contract specifications and facts about Eurodollar futures.

Learn More

T-Bond Futures

Learn contract specifications and facts about T-Bond futures.

Learn More

T-Note Futures

Learn contract specifications and facts about T-Note futures.

Learn More

Feeder Cattle Futures

Learn contract specifications and facts about feeder cattle futures.

Learn More

Lean Hog Futures

Learn contract specifications and facts about lean hog futures.

Learn More

Live Cattle Futures

Learn contract specifications and facts about live cattle futures.

Learn More

Milk Futures

Learn contract specifications and facts about milk futures.

Learn More

Copper Futures

Learn contract specifications and facts about copper futures.

Learn More

Gold Futures

Learn contract specifications and facts about gold futures.

Learn More

Palladium Futures

Learn contract specifications and facts about palladium futures.

Learn More

Platinum Futures

Learn contract specifications and facts about platinum futures.

Learn More

Silver Futures

Learn contract specifications and facts about silver futures.

Learn More

CRB CCI Index Futures

Learn contract specifications and facts about CRB CCI Index futures.

Learn More

DJIA Futures

Learn contract specifications and facts about DJIA futures.

Learn More

NASDAQ 100 Futures

Learn contract specifications and facts about NASDAQ 100 futures.

Learn More

Russell 2000 Futures

Learn contract specifications and facts about Russell 2000 futures.

Learn More

S&P 500 Index Futures

Learn contract specifications and facts about S&P 500 futures.

Learn More

Cocoa Futures

Learn contract specifications and facts about cocoa futures.

Learn More

Coffee Futures

Learn contract specifications and facts about coffee futures.

Learn More

Cotton Futures

Learn contract specifications and facts about cotton futures.

Learn More

Lumber Futures

Learn contract specifications and facts about lumber futures.

Learn More

Orange Juice Futures

Learn contract specifications and facts about orange juice futures.

Learn More

Sugar Futures

Learn contract specifications and facts about sugar futures.

Learn More

Technical Analysis Learning Center

Our futures chart technical analysis learning center comes with numerous studies. Default parameters for each study are shown below, the user can change the parameters for the study after it has been applied to the chart.

Learn More

Bollinger Bands

Bollinger Bands consist of a Moving Average and two standard deviations charted as one line above and one line below the Moving Average. The line above is two standard deviations added to the Moving Average. The line below is two standard deviations subtracted from the Moving Average.

Learn More

Envelope

Envelopes represent bands that are plotted in a certain, identical relationship above and below the Moving Average. Envelopes are a very complex theme with many interpretation and trading rules. Basically, envelopes capture a significant part of price movements.

Learn More

Commodity Channel Index

Commodity Channel Index is designed to detect beginning and ending market trends. This study measures the distance between the share prices and their Moving Average, and thus allows a measurement for the trend strength and/or intensity

Learn More

Crack Spread

The CRACK spread study is a futures transaction that parallels the process of refining Light Crude Oil (CL) into petroleum products, such as Heating Oil (HO) and Unleaded Gas (HU). Since the refining process involves “cracking” crude oil into its major components, the spread is referred to as a crack.

Learn More

Crush Spread

The CRUSH spread study is a futures transaction that parallels the process of producing bean oil (BO) and soymeal (SM) from soybeans (S). This study will only work with S, BO, and SM contracts on a daily chart.

Learn More

Default

Each study has its own set of properties which may be modified. Certain studies (such as Bollinger Bands, Exponential Moving Average, and Momentum), perform their calculations using a specific value (Field) from the underlying data on which the study is applied. When the study is initially applied to a chart, it “binds” itself to this Field, which is set in the study properties.

Learn More

Directional Movement Index

The concept of Directional Movement is based on the assumption that in an upward trend today’s highest price is higher than yesterday’s highest price, and in a downward trend today’s lowest price is lower than yesterday’s lowest price.

Learn More

Exponential Moving Average

The Exponential Moving Average gives the recent prices an equal weighting to the historic ones. The calculation does not refer to a fixed period, but rather takes all available data series into account. This is achieved by subtracting yesterday’s Exponential Moving Average from today’s price.

Learn More

Exponential Oscillator

The Exponential Oscillator is plotted as a histogram, using the difference between two Moving Averages. It can be used to help identify divergences, short-term variations from the long-term trend, and to identify the crossing of two Moving Averages, which occur when the oscillator crosses the zero line.

Learn More

High Low Moving Average

The High Low Moving Average study allows you to quickly and easily compute a simple moving average of the high and low for the interval. The length of the moving average may vary for the high and low.

Learn More

Highest High / Lowest Low

The mathematics defines an envelope of values by using the Highest High or the Lowest Low of the Last ‘n’ Periods.

Learn More

Historic Volatility

Although traders cannot predict the future, they must make intelligent guesses as to what the future holds. A standard approach used in option evaluation is to look at the past. What has historically been the volatility of a certain commodity?

Learn More

Keltner Channel

This moving average system by Chester W. Keltner consists of an n-day moving average of the “typical price” (sometimes referred to as “average price,” ((H+L+C)/3), plotted with a channel formed by adding and subtracting an n-bar moving average of the high-low range to or from the moving average of the typical price. Thus, the width of the channel adjusts to market volatility.

Learn More

Least Squares Linear Regression

The Least Squares Linear Regression line indicates the dominant market trend relative to time. In simple terms, is the market trending lower or higher with respect to time? It can inform you when the market is diverging from an established trend, but only when prices fluctuate uniformly around the trendline and within a narrow range.

Learn More

Line Oscillator

This study is a combination of two different studies. The first set of calculations compute a simple oscillator. The second part computes a simple moving average of the oscillator. You must specify two values for the moving averages to calculate the oscillator. Next, a third value is specified for a moving average of the oscillator. The application computes the values and displays two lines on the chart.

Learn More

Momentum

Momentum is an oscillator-type study used to interpret overbought/oversold markets. It assists in determining the pace at which price is rising or falling. This indicates whether a current trend is gaining or losing momentum, whether or not it is overbought or oversold, and whether the trend is slowing down.

Learn More

Moving Average

Moving Average is generally used to identify or confirm a trend, and works best in trending markets. It will not signal you that a trend change is imminent, but it will help you to determine if an existing trend is still in motion and help you to confirm when a trend reversal has taken place.

Learn More

Moving Average Convergence Divergence

The MACD is both a trend follower and an oscillator. The abbreviation stands for Moving Average Convergence Divergence. It is the difference between a fast Exponential Moving Average (EMA) and a slow Exponential Moving Average.

Learn More

Moving Standard Deviation

Moving Standard Deviation is a statistical measurement of market volatility. It makes no predictions of market direction, but it may serve as a confirming indicator. You specify the number of periods to use, and the study computes the standard deviation of prices from the moving average of the prices.

Learn More

Open Interest

Open Interest shows the number of open contracts of a given option or futures contract. An open contract can be a long or short contract that has not been exercised, closed out, or allowed to expire.

Learn More

Oscillator

The oscillator can be used to help identify divergences, short-term variations from the long-term trend, and to identify the crossing of two Moving Averages, which occur when the oscillator crosses the zero line.

Learn More

Parabolic Stop and Reversal

The Parabolic Stop and Reversal is a simple study to use. The study continuously computes “stop and reverse” price points. Whenever the market penetrates this “stop and reverse” point, you liquidate your current position and take the opposite position. If long, you liquidate the long position and establish a short position. If short, you liquidate the short position and establish a long position.

Learn More

Rate of Change

The Price Rate of Change study is first calculated by dividing the price change over the last ‘n’ periods by the closing price of the instrument ‘n’ periods ago. The result is the percentage by which the price has changed over the last ‘n’ periods.

Learn More

Relative Strength Index

The Relative Strength Index, developed by Welles Wilder is a special form of the Momentum and probably the most widely used contra-trend-oscillator. Contrary to the implications of its name, the study does not show the instrument’s strength in comparison to other instruments, but rather the instrument’s internal strength compared to its former prices.

Learn More

Smoothed Moving Average

A Smoothed Moving Average is an Exponential Moving Average, only with a longer period applied. The Smoothed Moving Average gives the recent prices an equal weighting to the historic ones. The calculation does not refer to a fixed period, but rather takes all available data series into account.

Learn More

Smoothed Oscillator

A Smoothed Oscillator is an Exponential Oscillator, only with a longer period applied. The Smoothed Oscillator is plotted as a histogram, using the difference between two Moving Averages. It can be used to help identify divergences, short-term variations from the long-term trend, and to identify the crossing of two Moving Averages, which occur when the oscillator crosses the zero line.

Learn More

Stochastic

The Stochastic Study, developed by George Lane, is an oscillator that compares the difference between the closing trade price of an instrument and the period low, relative to the trading range over an observation time period. With the help of this study, the position of the price quotation within the prevailing fluctuation margins is quantified.

Learn More

Slow Stochastic Oscillator

When it comes to understanding the trending market, the Slow Stochastic Oscillator is a helpful component of any trading strategy. The oscillator works by comparing the difference between the closing trade price of an instrument and the period low relative to the trading range over an observation time period.

Learn More

Variable Moving Average

The Variable Moving Average study allows you to get very creative with the moving averages. Three moving averages are applied (normal, exponential, and smoothed).

Learn More

Volume

Volume displays the volume of an instrument. It can be plotted as a line-chart or a histogram. It is not currently applicable for Intraday charts and will never be applicable for Tick charts, due to the nature of the data.

Learn More

Volume and Open Interest

Volume and Open Interest can be a barometer of future activity and direction. Volume measures the number of contracts that exchanged hands during the trading session. It measures market activity. Open Interest is the total number of outstanding contracts. It gauges market participation.

Learn More

Weighted Close

The Weighted Close study is another way of viewing the price data. It is an average of each day’s price, placing a greater emphasis on the closing price rather than the high or low. This process creates a single line chart.

Learn More

Williams’ %R

The Williams’ %R is designed to show the difference between the period high and today’s closing price with the trading range of the specified period. The study, therefore, shows the relative situation of the closing price within the observation period.

Learn More

Basic Training for Futures Traders

Get futures trading training tips and tricks from experienced futures trading brokers.

Learn More

Futures & Options Strategy Guide

Learn 25 futures and options trading strategies in this easy-to-read guide.

Learn More

Introduction to E-mini Stock Index Futures

This guide covers the S&P 500, Dow Jones Industrial Average, and the NASDAQ Composite, as well as discussing tips and strategies for trading them.

Learn More

Gold Products Overview Course

This comprehensive CME Group lesson will teach you the importance of paying attention to current economic and political events in the U.S. when trading gold, how gold is used as a hedge for non-U.S. economics, why gold is often viewed as a “safe” commodity during times of economic hardship, and more!

Learn More

Futures Trading: Technical Analysis for Beginners

Get helpful advice on technical analysis for futures traders in this e-book.

Learn More

Introduction to Oil Futures

Our free eBook covers essential topics like top reasons for participating in crude oil futures, crude contract specifications, fundamental market considerations, and more!

Learn More

Technical Analysis for Your Grain Marketing

This guide will teach you how to use technical analysis tools such as trend lines, channels, and price patterns, relative strength index and major moving averages, and TAS Market Profile, Navigator, and Boxes.

Learn More

Course: Futures vs. ETFs

This course explains the differences between futures and exchange-traded funds, why they’re popular among investors, and the advantages and disadvantages of each.

Learn More

Webinar: The Future of Sustainable Investing

Index product experts explain the importance of sustainable investing and why it matters for the future.

Learn More

Course: Things to Know Before Trading CME Group Futures

Trading futures is different from trading stocks or exchange-traded funds. This kind of trading tends to work best in markets that are especially liquid. CME Group's in-depth course will explore various aspects of trading futures contracts.

Learn More

Course: Options Strategies

Options strategies are an important aspect of any trader’s portfolio. Learn more about how these trading techniques can be used when responding to market direction and expected volatility in CME Group’s “Options Strategies” course.

Learn More

Course: Trading Psychology

One of the most daunting obstacles you’ll face when becoming a futures trader can be learning how to master your own mind. Why? Your success is largely dependent on the ability to learn from failure—and no one likes to fail.

Learn More

Course: Futures vs. ETFs

When it comes to futures versus ETFs, both are used to diversify investor portfolios, but does one offer more advantages than the other? This course explains the differences between futures and exchange-traded funds, why they’re popular among investors, and the advantages and disadvantages of each.

Learn More

Webinar: Getting Started with Micro Bitcoin Futures

Delve into the world of Bitcoin with this online webinar, Getting Started with Micro Bitcoin Futures. With a value of one-tenth of a single Bitcoin, Micro Bitcoin future contracts provide investors with economical ways to maximize Bitcoin exposure and optimize their cryptocurrency strategies.

Learn More

Course: An Introduction to Crude Oil

Familiarize yourself with today’s vast global crude oil market in this Introduction to Crude Oil course. Explore the fundamentals of modern energy markets, which can have a significant impact on many of the world’s leading economies.

Learn More

The Big Picture: A Cost Comparison of Futures and ETFs

Understand the cost and capital efficiency of futures contracts versus ETFs. The Big Picture: A Cost Comparison of Futures and ETFs explores the cost of replicating S&P 500 total returns using equity index futures and ETFs across numerous use cases.

Learn More

Course: Introduction to Options

As an important part of any successful trader’s technical arsenal, options can be used to predict volatility, market direction, hedge positions, and more. This comprehensive course from CME Group will help traders of any experience level learn more about options, exploring subjects such as contract details, theoretical pricing, expiration dates, and intrinsic value.

Learn More

Course: Introduction to Equity Index Products

Learn how Equity Index Products are used to manage risk, seek profit, and more. This course explores equity index futures, or cash-settled contracts that give market participants the ability to hedge or express opinions in the equity index market. In just a single transaction, traders can use these index-based contracts to manage risk or seek profit based on stock market predictions.

Learn More

Course: Gold Products Overview

One of the most widely traded commodities across the globe, gold futures products can be used to diversify trader portfolios and mitigate risk. Viewed as a “safe haven” during periods of economic uncertainty or political upheaval, gold futures prices often move inverse to the U.S. dollar, treasury bonds, and stock indexes.

Learn More

Course: Silver Products Overview

A useful tool that can serve as an inflation hedge, silver is the most widely used precious metal in history and has been mined for thousands of years. Historically used as currency, silver shares many of the “safe haven” characteristics of gold.

Learn More

Webinar: Trading Crude Oil and Natural Gas Options

Energy markets carry a large percentage of today’s global economies, influencing nearly every nation in some way. Futures and options on crude oil, refined products, natural gas, power, and coal help investors of any experience level mitigate risk and maximize the potential of these resources.

Learn More

Course: Key Economic Events

A variety of factors can impact the market, especially key economic events that can shift prices up or down. These economic factors can include changes in sales or commodity consumption, shortages, supply and demand, releases made by certain government entities, and more.

Learn More

Course: Introduction to Bitcoin

Dive into the world of Bitcoin with this comprehensive online course. Created in 2009, Bitcoin is a type of decentralized cryptocurrency that can be transferred from one party to another without the need for intermediation from a central authority.

Learn MoreSorry! There weren't any results for that filter, please try something different

Level Up Your Trading Strategies

Learn the ins and outs from the pros & get the essentials straight to your inbox.